Your cart is currently empty!

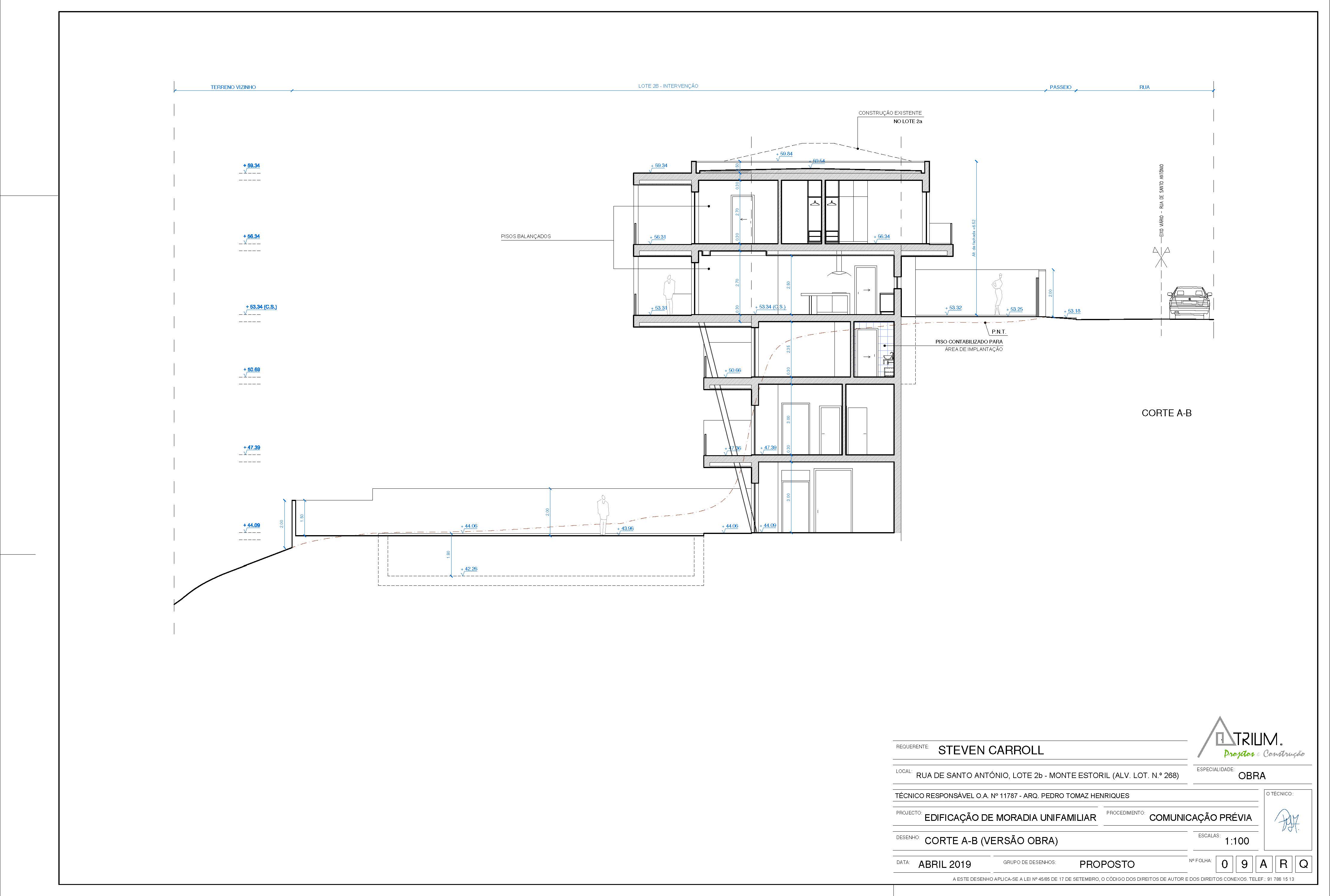

Monte Estoril Residences

Introducing two standalone residences, each spanning five stories on individual plots of 350m2, situated on R. Santo António in the coveted Monte Estoril region. Each house offers 156m2 of living space, complemented by 150m2 of internal terraces. With an approximate valuation of 2.5m€ per unit, this venture presents significant tax advantages, including exemption from final sales tax. The vision behind the project: Craft two state-of-the-art residences and retain one. All preparatory stages are complete – land secured, architectural designs finalized, and existing planning permissions obtained. We’re poised for construction and are seeking a single investment partner to collaborate with. Project completion is anticipated in two years.

Download 3d model:

Download architectural plans phase 1:

Download an investor contract explaining expected terms between interested parties.

Final phase two complete download plan:

Associated project management responsibility list and contract.

The Smart Energy Plan: A Financial Perspective

Owning a home comes with inherent costs. Monthly utility bills for electricity, gas, and water services can accumulate, often becoming significant annual expenses. For many homeowners, these costs represent a substantial portion of their yearly budget.

The Smart Energy Plan addresses this financial concern head-on. Traditional homes, tethered to external utility services, are subject to the unpredictability of market rates, potential price increases, and the inevitable cost of consumption. Over a year, these expenses can amount to upwards of €15,000 or more, depending on the size and location of the property.

Our approach with the Smart Energy Plan is to minimize, and in many cases eliminate, these recurring costs. By incorporating advanced systems like solar energy generation, water boreholes, and efficient waste management, the reliance on external utilities is drastically reduced. The result? A home that is nearly self-sufficient, with annual running costs approaching zero.

When viewed over the long term, the financial benefits become even more apparent. Over a decade, homeowners could retain up to €150,000 that would otherwise be spent on utilities. This isn’t just a saving; it’s a significant financial asset.

In essence, the Smart Energy Plan isn’t merely about sustainable living; it’s a sound financial strategy for homeowners looking to maximize their investment and minimize their expenses.

Associated smart energy plan responsibility list and contract.

Financial Comparison

The structure proposed in this document influences how investments are allocated between conventional and suggested costs, impacting the value embedded in a comparably priced property. Herein, we aim to illustrate the distribution and expenditure across various facets of a project for a typically valued property.

Scenario A: Typical Purchase

- Agent Fee: 6% of €2,000,000 = €120,000

- VAT on Agent Fee: 23% of €120,000 = €27,600

- VAT on Property Price: 23% of €2,000,000 = €460,000

- Developer’s Profit: €400,000

- Capital Gains Tax: This will be a percentage of the Developer’s profit. Let’s assume 25%.

- Dividend Tax or Employee Tax: This will be a percentage of the Developer’s profit after capital gains tax. Let’s assume 20%.

- Wealth Tax (AIMI): 0.8% per year on fiscal value over €600,000.

Scenario B: Investor-Developer Agreement

- Land Transfer Fee: 7% €10,750

- No agent fee, VAT, developer’s profit, capital gains tax, dividend tax, or wealth tax are applicable in this scenario.

Calculations for Scenario A:

- Agent Fee: €120,000

- VAT on Agent Fee: €27,600

- VAT on Property Price: €460,000

- Developer’s Investment €994,571

- Developer’s Profit (0.4X) = €397,829

- Capital Gains Tax: 25% of €397,829 = €99,457

- Dividend Tax or Employee Tax: 20% of (€397,829 – €99,457) = €59,674

- Wealth Tax (AIMI): 0.8% of (€2,000,000 – €600,000) = €11,200 per year

Chart:

| Factor | Scenario A (€) | Scenario B (€) | Difference (€) |

|---|---|---|---|

| Budget | 2,000,000 | 2,000,000 | 0 |

| Agent Fee | -120,000 | 0 | 120,000 |

| VAT on Agent Fee | -27,600 | 0 | 27,600 |

| VAT on Property Price | -460,000 | 0 | 460,000 |

| Developer’s Profit | -397,829 | 0 | 397,829 |

| Capital Gains Tax | -99,457 | 0 | 99,457 |

| Dividend Tax or Employee Tax | -59,674 | 0 | 59,674 |

| Wealth Tax (AIMI) | -11,200/year | 0 | 11,200/year |

| Land Transfer Fee | 0 | -8,750 | -8,750 |

| Final Value in Property | 944,240 | 1,991,250 | 1,047,010 |

Notes:

- Scenario A: The final value in the property is significantly reduced due to various taxes and fees.

- Scenario B: More of the initial investment goes directly into the property, as many of the taxes and fees are not applicable.

This chart provides a visual representation of how the two different investment structures can impact the final value invested in the property. Always consult with a financial advisor or tax expert for precise calculations and advice tailored to specific investment scenarios.

Investment Cost Breakdown

Price Per Meter Compassion:

Another way to evaluate is by looking at the cost per square meter in relation to the final price. If our projected total costs are around 2 million euros, this would indicate a final price of approximately 6,666 euros for every square meter of usable space. This is notable, especially when properties nearby frequently list at 14,000 euros per square meter for new apartments. However, our offering is unique as it’s a freehold property that comes with 350 square meters of land and no associated condominium fees.

Apartment vs Freehold

In the realm of real estate, the challenges often associated with condominiums and leaseholds, such as limited control over shared spaces, escalating maintenance fees, and the constraints of homeowners’ associations, can be significant deterrents for discerning investors. Additionally, the ticking clock of leasehold properties, which can depreciate as their lease term shortens, adds another layer of complexity. Contrast this with the Monte Estoril Residences (MER), which stands as a beacon of modern luxury and autonomy. With MER, investors are not only granted freehold ownership, ensuring complete control over both the property and the land, but they also step into the future of sustainable living. The added benefits of sustainable energy solutions and self-sufficiency present a compelling investment proposition. These features not only align with global sustainability trends but also promise tangible financial benefits through savings and potential appreciation. In the balance of luxury living and forward-thinking investment, Monte Estoril Residences clearly emerges as the choice for the future.

Deadline for proposals

We are now accepting final proposals for the Monte Estoril Residences until the end of November 2023. For those interested in a comprehensive bill of materials and detailed engineering plans, please reach out to us.

by

Tags:

Leave a Reply